Overpriced & Delusional: A Palm Springs Buyer’s Tale 🏜️

As a Palm Springs Realtor with over 25 years of experience and the founder of The Paul Kaplan Group, I spend my days analyzing buyer behavior, tracking comps, and advising sellers on how to price their homes in a constantly shifting Palm Springs and Coachella Valley real estate market. But right now, I’m also wearing another hat—I’m an active buyer and personal investor shopping for my own next property.

And let me tell you something that every seller thinking about overpricing their home needs to hear:

👉 Buyers aren’t confused. They aren’t emotional. And they definitely aren’t unaware of the comps.

Today’s Palm Springs buyers are informed, analytical, and cautious. They’ve seen the market peak, they know interest rates are higher, and they’re watching price reductions stack up across Palm Springs, Palm Desert, Rancho Mirage, and Cathedral City. So when a new listing pops up priced well above recent closed sales, the internal dialogue is almost always the same:

“What’s wrong with this one?”“Why didn’t they price it correctly?”“How long is this seller going to chase the market down?”

As both a local Palm Springs listing agent and a buyer myself, I can tell you firsthand—when I see an overpriced home, I don’t think maybe I should stretch. I think I’ll wait. Or worse, I move on entirely.

That’s the reality sellers often miss.

When a home is priced above the comps, buyers don’t rush in with offers. They sit back. They watch. They bookmark the listing and wait for the inevitable price reduction. And by the time the price finally becomes reasonable, the property has already picked up something far more damaging than a lower number—stigma.

In this market, pricing a home correctly from day one isn’t about selling fast or leaving money on the table. It’s about aligning with how buyers actually think and behave in today’s Palm Springs real estate market. I see it every day with my clients—and I’ve experienced it personally while shopping for my own home.

And that’s exactly why this conversation about overpricing matters now more than ever.

Here are two recent examples I ran into on my owner personal house hunting search:

House #1: Love at First Showing 💘

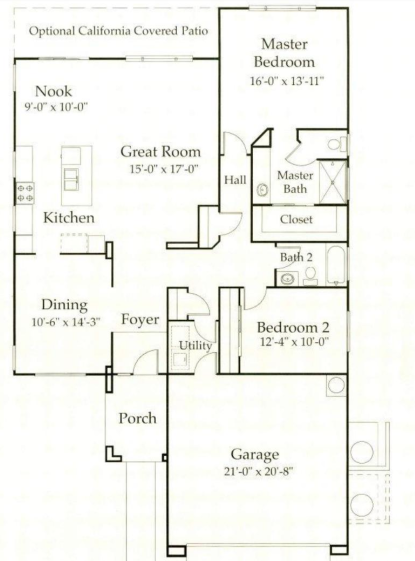

I walk into this place and think, Okay… this could work.Yes, it needs the usual Palm Springs starter pack:

- Kitchen update

- Bathrooms from the Clinton administration

- HVAC that looks tired just thinking about summer

But still—good bones, good location, right complex. I’m in.

Then I look at the price.

Hmm. That feels… optimistic.

So I do what Realtors do:

- Check the comps → more updated homes sold for less

- Check the purchase history → they bought it 18 months ago

And now they’re asking… almost 30% more.

Now listen—I love Palm Springs as much as anyone. But the market has not gone up 30% in the last 18 months. Not even close. Across the board, we’re talking low single-digit appreciation to relatively flat, depending on neighborhood and property type. This isn’t 2021. We’re not drunk on cheap money anymore.

So I think, Okay… maybe they remodeled?

I call the listing agent.

Agent: “They added wallpaper to the bathrooms and put a fence around the yard.”

Oh.Wallpaper. And a fence.

Let’s be wildly generous:

- Wallpaper: $5,000 per bathroom

- Fence: $10,000

So… $20,000-ish in improvements.

And that justifies a 30% price increase?

Agent-to-agent call continues:

Agent: “Just submit an offer and let’s see where it goes.”

Me?No thanks.

If a property is that overpriced, my offer would be so far below ask it would feel less like negotiating and more like performance art. I’ll pass—and just watch for the inevitable price reduction.

House #2: Déjà Vu, But Worse 🔁

Next house. Different day. Same story.

Love the layout. Needs very little work. Checks all the boxes.

Then I look at the price.

Again… 20% higher than the comps.

Ownership history?They’ve had it four years and priced it 20% above what they paid.

I get it. No one wants to lose money after commissions, taxes, and closing costs. But here’s the problem:

👉 The market does not care what you paid.👉 Buyers do not care what you need.👉 Only the comps matter.

So I call the agent.

Me: “Can you walk me through the comps you used for pricing?”Agent: “We priced it based on what the seller wants.”Me: “So… not on closed sales?”Agent: “There are comps in the complex.”Me: “The ones that are 20% larger?”Agent: “Well, yes. But there are also other homes for sale at similar prices.”Me: “Right—but those are active listings. You price from closed sales.”Agent: “That’s just what she wants for it.”

Ah yes.The highly scientific ‘She Wants This’ pricing model.

Did I submit an offer?Absolutely not.

Fast-forward three months:

- Two price reductions

- Still overpriced

- A new listing pops up in the same community

- More updated. Over 10% cheaper.

As a buyer, all I can think is:PHEW. Dodged that bullet. I’d already be underwater.

So… What Are Overpriced Sellers (and Their Agents) Thinking? 🤔

Some common theories:

- “My house is special.”

- “Someone will fall in love and overpay.”

- “Buyers don’t really know the comps.”

- “We can always come down later.”

Here’s the hard truth after 25 years in real estate:

That magical buyer willing to wildly overpay?🧵 Needle. Haystack.

And here’s the kicker—the data backs this up.

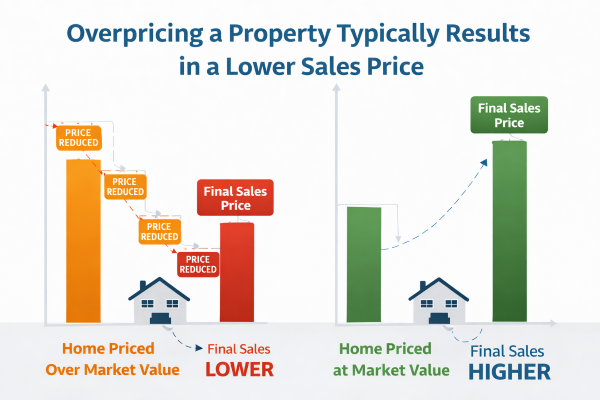

Why Overpriced Homes Often Sell for Less 📉

This part surprises sellers every time:

- You miss the best buyers.The most qualified, informed buyers watch new listings closely. When they see a home that’s obviously overpriced, they don’t “wait and see”—they move on.

- Days on Market become a red flag.The longer a home sits, the more buyers assume something is wrong. Even after price reductions, the stigma sticks.

- Chasing the market down hurts leverage.Multiple reductions signal desperation. Buyers don’t think, “Now it’s fairly priced.” They think, “How low will they go?”

- You end up below where you should’ve been.Had the home been priced correctly from day one, competition may have driven the price up—or at least held it steady. Instead, it limps to the finish line.

Ironically, overpricing often costs sellers more than pricing it right to begin with.

Final Thought: Pricing Reality Check (Palm Springs Edition) 🏜️

Here’s the honest Palm Springs real estate truth, and we say this as both full-time Realtors and long-term investors who live and work in this market every day:

At The Paul Kaplan Group, we don’t take overpriced listings just to “test the market.” In fact, we’ll sometimes turn down a listing altogether if a seller is unwilling to price their home realistically—even after we’ve walked through the Palm Springs comps, recent closed sales, neighborhood trends, and current market conditions. Why? Because overpricing wastes your time, our time, and ultimately costs you money.

And yes—full transparency—this market doesn’t reward denial pricing.

If we wanted a quick commission, we’d say yes to every unrealistic price and quietly wait for the inevitable price reductions. But that’s not how experienced Palm Springs listing agents work. Our goal isn’t just to sell your home—it’s to sell it for the highest price the market will actually support, within the right timeframe, so you can confidently move on to your next chapter.

Sometimes that means a little tough love. Not because we want to sell your home fast—but because we want it to sell well.

Think about it: if your home sells for more, our commission is higher too. We’re fully aligned with you. But chasing a number the market doesn’t support only leads to longer days on the market, price reductions, and buyers wondering what’s wrong with the house.

So if you’re thinking about selling a home in Palm Springs, Rancho Mirage, Palm Desert, Cathedral City, or anywhere in the Coachella Valley, we’d love to meet with you. We’ll give you a clear, data-driven pricing strategy based on real comps, real buyer behavior, and real results—not wishful thinking.

📩 Reach out to The Paul Kaplan Group for an honest conversation, smart pricing, and a selling strategy designed to get your home sold—not just listed.

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.