Navigating Lease Land: What You Need to Know Before Buying a Home in Palm Springs

Palm Springs, with its mid-century modern architecture, stunning desert landscapes, and vibrant community, is a dream destination for many. But when it comes to buying a home here, there's a unique concept you need to understand: lease land.

A History of Lease Land:

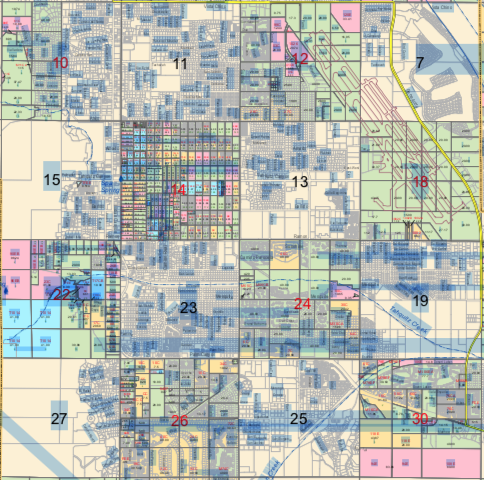

A significant portion of Palm Springs sits on land owned by the Agua Caliente Band of Cahuilla Indians. In the mid-20th century, the tribe leased this land to developers for residential construction. These leases typically last for 50-99 years, with the option for renewal. Today, over 23,000 homes in the Coachella Valley are built on lease land.

Considering a Lease Land Property?

The allure of Palm Springs can make lease land properties seem attractive, often priced lower than traditional fee land homes. But before you dive in, here are some crucial factors to consider:

- Financing Challenges: Many lenders are hesitant to offer traditional mortgages on lease land. You may encounter stricter lending requirements, higher down payments, or even difficulty securing a loan altogether.

- Lease Expiration: Leases have an expiry date. While most haven't expired yet, consider the long-term impact. The future cost of renewing the lease and potential limitations on your ability to sell the home before the lease expires are important factors.

- Lease Renewal Costs: Lease renewals are not guaranteed and can come with significant price increases. Research the historical lease renewal rates for the specific property and factor those potential costs into your decision.

- .

Here are some additional points to keep in mind:

- Land Lease vs. Home Ownership: When you buy on lease land, you own the structure (your home) but not the land beneath it. You'll pay a monthly or annual ground rent to the tribe.

- Review the Lease Agreement Carefully: The lease agreement outlines your rights and responsibilities, including rent increases, maintenance obligations, and renewal procedures. Ensure you understand all the terms before committing.

- Seek Expert Advice: Consult a real estate professional experienced in lease land transactions and a lawyer specializing in real estate law.

The Bottom Line:

Lease land can be a viable option for some Palm Springs homebuyers. However, it's crucial to go into the process with your eyes wide open. By carefully considering the lending limitations, potential lease expiration and renewal costs, and thoroughly understanding the lease agreement, you can make an informed decision about whether a lease land property aligns with your long-term goals.

The information above is provided for general information purposes only and should not be relied upon as legal or tax advice. All land leases are unique and it’s important to carefully review all contracts, leases and information about the specific property, structure and lease prior to entering into a transaction. Please consult with your financial advisor, tax advisor and legal counsel when considering and/or undertaking any purchase of lease land or fee land.

Disclaimer:The information provided in this blog is for general informational purposes only and should not be construed as legal, financial, or tax advice. Real estate transactions can have significant financial and legal implications, and each situation is unique. Readers are strongly encouraged to consult with qualified professionals—including a licensed lender, accountant, attorney, and/or financial advisor—before making any decisions related to mortgages, loans, taxes, contracts, or real estate transactions. The Paul Kaplan Group and its agents make no guarantees as to the accuracy, completeness, or applicability of the information provided, and assume no liability for actions taken in reliance upon it.

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.