How to sell a home in Palm Springs in 2025 without remodeling

Higher borrowing costs have reshaped how both buyers and sellers approach Palm Springs real estate in late 2025. Across the Coachella Valley—from Palm Springs and Cathedral City to Palm Desert and Rancho Mirage—many homeowners are rethinking the old playbook of pouring money into pre-sale renovations and hoping to get every dollar back.

Instead, a smarter, more flexible strategy is gaining traction:offering improvement credits or allowances rather than doing full renovations before you list.

As local Palm Springs listing specialists at The Paul Kaplan Group / Bennion Deville Homes, we’re using this approach more often to help our sellers stand out in a high-rate market—especially with mid-century modern homes, condos, and resort properties.

Why improvement credits fit the 2025 Palm Springs market

1. High interest rates + affordability challenges

Mortgage rates in late 2025 remain elevated compared to just a few years ago. Monthly payments for a Palm Springs home—whether it’s a mid-century Alexander, a Sunrise Park condo, or a golf-course property in Palm Desert—are simply higher than many buyers anticipated.

That means:

- Buyers are payment-sensitive and watching every dollar.

- There’s less room in the budget to pay a premium for “just completed” renovations.

- Incentives like closing-cost credits, repair allowances, and rate buydowns are now common expectations, not rare perks.

Instead of guessing which upgrades will justify a higher list price, Palm Springs sellers are often better off saying:

“We’ll give you a credit for new flooring / pool resurfacing / kitchen updates,”

and letting the buyer decide what matters most.

This works especially well in our local market, where one buyer wants to restore original mid-century details, and the next wants a sleek, contemporary desert look. A one-size-fits-all remodel can actually turn people off.

2. Buyers value personalization—especially in a design-driven city

Palm Springs attracts buyers who care deeply about design: mid-century modern purists, architecture buffs, and lifestyle buyers looking for a very specific aesthetic.

Many of today’s buyers would rather:

- Choose their own tile for the pool spa.

- Pick the exact slab for new quartz counters.

- Decide between polished concrete floors or terrazzo-look tile.

When a seller spends heavily on renovations before listing, buyers may feel like they’re paying a markup for changes they would have done differently anyway. An improvement credit solves that:

- Buyers get to personalize the property—on their own timeline and to their own taste.

- Sellers avoid the risk of spending $30,000–$80,000 on updates that might only add a fraction of that in perceived value.

For many of our Palm Springs sellers in 2025, this has been the difference between a listing that lingers and one that gets solid activity right away.

3. Renovation costs are still high in the desert

Construction and remodel costs across the Coachella Valley remain elevated, and trades are busy—especially for:

- Pool and hardscape work

- Kitchen and bath remodels

- Full-house flooring changes

- Energy-efficiency upgrades (dual-pane windows, mini-split systems, insulation)

Even “simple” projects can run into delays, permitting issues, and cost overruns. Historically, most renovations only recoup a portion of their cost at resale, and that gap can widen when costs are high.

By contrast, an improvement credit:

- Is clean and predictable—the amount is agreed upon in the purchase contract.

- Doesn’t require the seller to manage contractors or navigate supply delays.

- Gives the buyer immediate flexibility right after closing.

For many Palm Springs homeowners who may be selling a second home or trust property from out of town, avoiding a major remodel is a huge relief.

How improvement credits work (Palm Springs edition)

Improvement credits are typically offered as financial allowances tied to the purchase contract and finalized in escrow. They can be structured in a few different ways:

- Closing-cost creditThe seller pays a portion of the buyer’s closing costs, freeing up the buyer’s cash to update items like flooring, paint, or a pool heater after closing.

- Repair allowance after inspectionIf the home inspection shows an aging roof, original HVAC, or older electrical, the parties can agree on a repair credit rather than requiring the seller to complete all work before close.

- Design/finish allowancePerfect for homes with solid bones but dated finishes:“$10,000 allowance for buyer’s choice of flooring, countertops, or bathroom updates.”

- Adjusted list priceInstead of a formal credit, the list price is clearly positioned to reflect needed updates—signaling to buyers that there’s room in the budget to customize.

Your Palm Springs agent (that’s where The Paul Kaplan Group comes in) can help you choose the structure that works best for your situation and for current lender guidelines.

How to present credits in your Palm Springs listing

The goal is to highlight flexibility and opportunity without making the home sound like a fixer.

Examples of listing language we might use:

- “Seller offering flooring credit—choose your own desert-friendly materials.”

- “Appliance allowance available with acceptable offer.”

- “Price reflects opportunity for buyer to customize kitchen and baths.”

- “Credit available toward pool resurfacing or new desert-landscape design.”

If we’ve obtained contractor estimates for specific projects (for example, new mini-split system or pool equipment), we can share those so buyers understand the scope. Transparent, professional presentation makes credits feel like a feature—not a warning sign.

Smart, minimal prep instead of full renovations

Even if you’re not doing a big remodel, your Palm Springs home still needs to show well. We recommend focusing on:

- Deep cleaning & declutteringDesert dust shows in photos—clean windows, fans, and sliders make a big difference.

- Minor repairsTouch up paint, fix loose door hardware, clean grout, and address obvious wear and tear.

- Staging for light and flowArrange furniture to showcase views, indoor-outdoor connections, and pool access.

- Consistent, bright lightingReplace dim or mismatched bulbs; desert evenings look best in warm, even light.

- Simple, neutral stylingFresh linens, a few desert-inspired accents, and well-maintained outdoor spaces (trimmed palms, clean pool) make the home feel move-in ready.

This “light lift” prep, paired with clear improvement credits, is often all that’s needed to attract strong offers in 2025.

When improvement credits work best in Palm Springs

We’re seeing this strategy perform especially well when:

- Inventory in the neighborhood is moderate to high, and buyers have options.

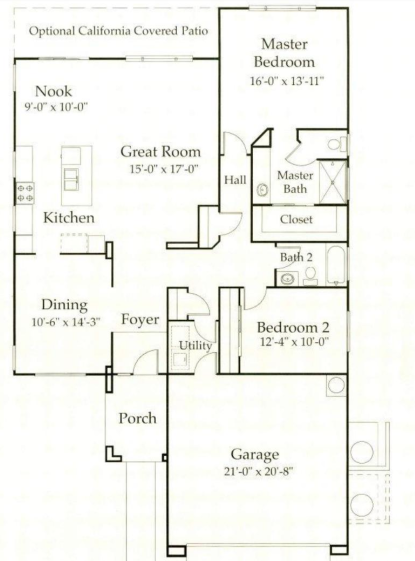

- The home has great bones—good layout, solid systems, pool, and views—but dated finishes.

- Sellers want to avoid the risk and stress of managing a big remodel, especially from out of area.

- The likely buyer is design-focused (very common in Palm Springs) or budget-conscious and willing to do cosmetic upgrades after closing.

In these cases, a clear, well-marketed credit can make your listing stand out from other “updated” homes that are priced at the very top of the market.

The takeaway for Palm Springs sellers

High mortgage rates have made buyers more selective and payment-focused, while elevated renovation costs have eaten into sellers’ returns on pre-sale projects. In today’s Palm Springs real estate market, offering improvement credits instead of full renovations can bridge that gap.

By:

- Keeping your upfront costs lower

- Helping buyers customize the home to their taste

- Avoiding renovation delays and surprises

…you align your listing with how buyers actually shop in 2025.

If you’re thinking about selling a home in Palm Springs, Cathedral City, Rancho Mirage, or Palm Desert and want to know whether improvement credits make sense for your property, the Paul Kaplan Group is happy to walk you through real-world numbers and strategies.